Prevention of Fair Lending Issues using FairBorrow™.Ai

Leverage the latest GenerativeAI features to gain critical insights and enhance the consistency of your decision making process.

At FairBorrow.Ai, we use publicly available data, such as Home Mortgage Disclosure Act (HMDA) data from the Consumer Financial Protection Bureau (CFPB), to demonstrate the power of Artificial Intelligence (AI) in developing powerful insights. In particular, our proprietary data management process helps to enhance the consistency of decisions, such as loan application decisions, potentially leading to a reduction in bias, and thus helping reduce or even eliminate potential regulatory issues such as Fair Lending issues and resulting adverse financial and reputational impact.

- Justice Department Reaches Settlement with Wells Fargo Resulting in More Than $175 Million in Relief for Homeowners to Resolve Fair Lending Claims

- USAA $85 Million penalty by the OCC after it uncovered evidence of discriminatory and illegal credit practice

- The nation’s largest credit union rejected more than half its Black conventional mortgage applicants (CNN December 14, 2023)

- CFPB Orders Citi to Pay $25.9 Million for Intentional, Illegal Discrimination Against Armenian Americans

- CFPB, DOJ Order Trident Mortgage Company to Pay More Than $22 Million for Deliberate Discrimination Against Minority Families

- CFPB, DOJ and OCC Take Action Against Trustmark National Bank for Deliberate Discrimination Against Black and Hispanic Families

Our Data Management process can consume proprietary data and implement a customized solution within a client’s domain, whether in the cloud or on-premise. For further inquiries, please email us at Info@fair.borrow.Ai.

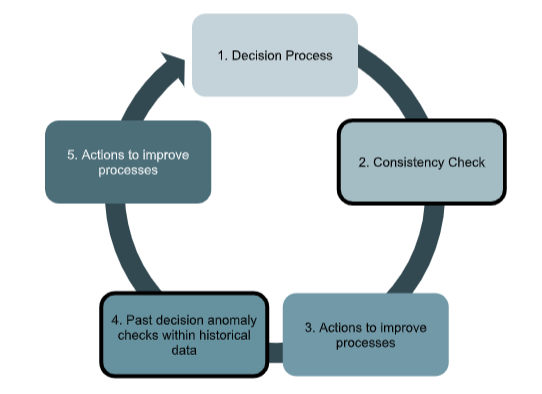

FairBorrow™.Ai enables a continuous improvement to the decision-making process by providing decision-makers, such as underwriters, the option to check their decisions for consistency. Such checks can be performed at single-decision levels, or in bulk, such as one week’s worth of loans. An underwriting team leader can, in some instances, also submit a group of loans on behalf of the members of the underwriting team. The consistency checks provide underwriters actionable intelligence on which areas to focus to reduce or eliminate decision consistency.

In addition, a risk manager can review decisions from the past to detect anomalies within various criteria of interest and quickly obtain actionable intelligence.

This constitutes a double-pronged approach to improving decision consistency, and along with the lender’s own quality assurance, loan reviews, procedures and training, can be effective in driving any inconsistency in the decision process lower.